Sears: The Titanic of retail

The Titanic of retail: Sears is 'set to sink' as stores close, executives flee, and the CFO admits the brand is falling short

Excerpt:

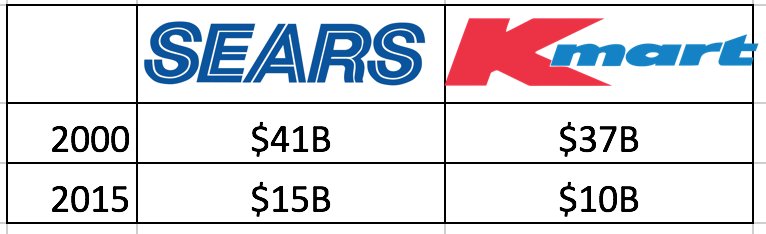

Neil Saunders, the CEO of the retail consulting firm Conlumino, likened Sears to the Titanic on Thursday, saying it "looks set to sink." In a note to clients, he said the company's plan to restore profitability is a sham, writing, "the funds raised are not being used to develop of growth the firm — they are being used to prop up an ailing and failed business." "In our view, it is now too late to turn this around," Saunders wrote. "It is just not financially feasible to reverse it."Comment: The end is near. Chart above is sales decline from 2000 to 2015. All Sears posts

Update: Sears Transformed America. It Deserves to Die With Dignity.

Sears revolutionized American retail not once but twice, and made a lot of Americans immeasurably better off. But Sears built a great business for an America that no longer exists: eyes on the burgeoning suburbs, lives centered on cars, aesthetics relentlessly bourgeois. That business required a lot of investment in both business expertise and real estate that the company could not change, or shed, as fast as America changed around it. And there's no shame in that. Even the brightest stars eventually burn out.

Update on 1/9/17: Inside Sears' death spiral: How an iconic American brand has been driven to the edge of bankruptcy

Lampert, a former Wall Street prodigy, took control of Sears more than a decade ago and became its CEO in 2013. But he's rarely seen in the office, typically visiting about once a year for the shareholder meeting and projecting into videoconference rooms at Sears' Hoffman Estates, Illinois, headquarters the rest of the time, according to interviews with employees. He prefers to stay on Indian Creek Island, off the coast of Miami, behind a desk dressed up with the Sears logo. The island has been dubbed the "billionaire bunker," partly because of a private police force that protects the island's 86 residents.

"The only way you see Eddie is through a screen," one former executive told Business Insider. "We used to joke about who had to go upstairs to get fixed and see Oz."

Lampert's physical absence might be better received if Sears, which also owns Kmart, was in better shape. But the retailer, famous for selling everything from shoes to vacuum cleaners to whole houses, is facing its biggest crisis ever. It's closing hundreds of stores. Others are in shambles, with leaking ceilings and broken escalators. In some, employees hang bedsheets to shield shoppers from sections that stand empty. ...

The employees who spoke to Business Insider describe an internal mess with a revolving door of executives and low morale. Senior executives say Lampert has cut investments in stores because he's trying to turn it into a tech company that collects and sells customer data through the Shop Your Way program. In the past, Lampert has defended his strategy, saying he intends to turn Sears into a more "asset-light" organization, but one that would still include physical stores. He denies widespread claims that he's stripping the company of all its most valuable properties and brands and hastening its bankruptcy. At the same time, he has executed a series of real-estate and financial transactions to help prop up Sears. While the failure of the company could certainly wipe out his hedge fund's investment in the stock, these deals have set Lampert up to benefit in other ways, creating a conflict of interest, a shareholder lawsuit claims.

Too big to sink, one would have thought. Crazy.

ReplyDeleteBut as I now live just a few miles from Sears HQ in Illinois and have a friend working there...it's been clear for years the executives have kept it going kept it afloat as long as they have simply to continue generating income for themselves. There's been little doubt of the final income for a long while now.

Wow, proofread much? Final *outcome.* Along with the other repetitive parts.

ReplyDeleteI remember the merger--K-Mart went bankrupt and used bankruptcy court to buy Sears. Doomed from the start, really. Sears prices with K-Mart quality is now how you take the fight to Wal-Mart and Target.

ReplyDeleteAnd I bet some of Tobin's neighbors have a spreadsheet on their laptop telling exactly when bankruptcy will be filed. It's a simple calculation of bleed rate and assets--friends of my dad's did it for Bethlehem Steel a while back before Arcelor Mittal bought them out.