Minnesota Homestead Classification

I was talking with Edina Realty Realtor Ray Klotz today and asked him about the Minnesota Homestead Classification. Here's how this works: The residential homestead classification

Excerpt:

Comment: Above image is from my property tax record showing that I have the Homestead Classification. Turns out that at the value of my own property, it means nothing!

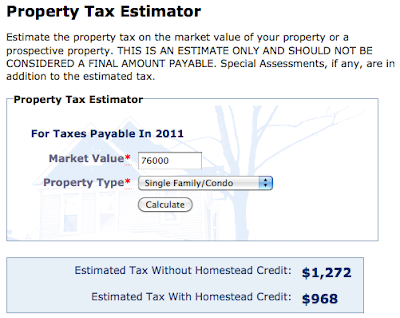

Illustrated by this City of Minneapolis property tax calculator:

Our property taxes (Plymouth MN) are lower than the City of Minneapolis, but at the property value of my home, the Homestead Classification benefit is negligible

Excerpt:

How much is the homestead credit?

The amount of the homestead credit varies depending on the market value of the property. The maximum amount of the credit is $304 for properties with a market value of $76,000. As the property’s market value increases above $76,000, the amount of the credit decreases.

Comment: Above image is from my property tax record showing that I have the Homestead Classification. Turns out that at the value of my own property, it means nothing!

Illustrated by this City of Minneapolis property tax calculator:

Our property taxes (Plymouth MN) are lower than the City of Minneapolis, but at the property value of my home, the Homestead Classification benefit is negligible

I miss MN taxes - even Hennepin County's. Compare to Kane County, IL, where we are now: http://www.co.kane.il.us/Treasurer/ptax.htm. The house we're trying to buy is in Dundee Township.

ReplyDeleteAdd that to a sales tax of 8-10.5% (depending on city), and the recently hiked state income tax, and you've got a widespread problem of politicians attempting to tax themselves out of debt. Gotta love it.