What I've learned about investing in Prosper

Introduction:

- My periodic post about Prosper!

- One has asked if it is unethical for me to lend on Prosper. This same one felt that it was unethical for me to invest in Fifth Third Stock. Both of these questions came about because I work for a financial (to remain unnamed) institution. To that one, who is my brother in Christ, I don't mind that you asked because of the old "iron sharpeneth iron" principle! If you have further questions about this please contact me personally for a sit down over coffee!

- We are required to take an ethics class every year and pass the test and sign the ethics book.

- Failure to comply to the code of ethics would be grounds for dismissal!

- Each division in our organization has an ethics code administrator. In December I emailed him and asked about buying stock in FITB and investing in Prosper. Our code administrator has both an MBA and a JD.

- About Fifth Third. Since I am not on the board of directors or in anyway entangled with the business of that bank, there is no code violation.

- About Prosper: Since I am an investor who purchases a share in a note (like buying a bond) and not a direct lender (although sometimes the nomenclature of "lender" is used), I am an investor and not a lender. There is no code violation.

- As an aside, I am a Christian (40 years now and counting) and I take ethics very seriously. That's why I contacted our code administrator and also copied my manager

- Additionally I serve in my local church. Any ethical misconduct could potentially reflect poorly on my church. So again I take that seriously as well!

- We are required to take an ethics class every year and pass the test and sign the ethics book.

- Generally what I have learned on Prosper is that is not easy to be a banker and is is not easy to make money lending to people. I had hoped to earn 10% per annum and so far I am earning just past 4%. That's still not bad, my CD's on INGDirect are paying 1.3%

- This blog post highlights my missteps and key learnings

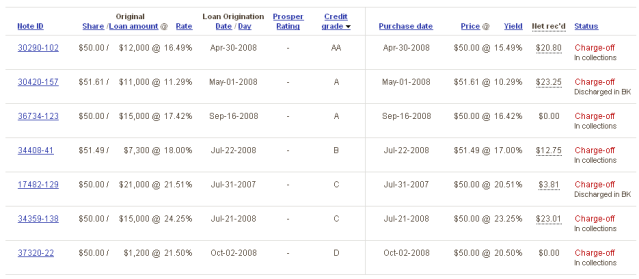

- The following image is a snap shot of where I stand to date!

- Notice that I am still net positive by $ 188.96

- I have lost (note charge offs) $ 298.96

- My charge offs will soon increase by $ 43.70

- If I took those charge offs today ...

- My net positive would be $ 145.26 and my charge offs $ 342.66

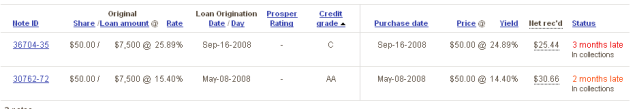

- The following 2 images detail the charge offs

Already charged off

Soon to be charged off

Here are my key learnings:

- Stick to grade AA and A

- I only have two AA charge offs .. totaling $ 48.54

- I have 2 A charge offs ... totaling $ 78.36

- My B, C, and D charge offs .... total $ 140.29

- Percentage wise, my AA and A loans are the vast majority of my notes

- Going forward, I only loan to AA and A borrowers

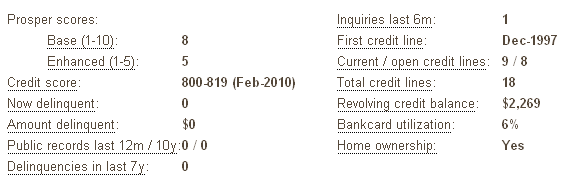

What I look for in a Prosper listing (below an actual snapshot of a recent loan)

- A long credit history. In this case 13 years

- No delinquencies in the last 7 years

- No current delinquencies

- A long employment status (not shown on this image)

- Low bank card utilization

- Low debt / income ratio

- A low revolving credit balance

- I favor those who own a home

As an aside, when we moved to Minnesota 16 years ago and I applied for a mortgage with Wells Fargo, my credit check came back with one late payment. I was asked about that. It was to Sears. I understand that sometimes some people make a late payment!

I also look for their reason to borrow money. I won't loan money in these cases:

- Getting married. Reason: Hey save up for that!

- Buying a ring. Reason: Ditto

- Honeymoon: Reason: Ditto

- Taking a vacation: Reason: Ditto

I have made many loans for the following reasons:

- Credit card consolidation

- Paying off a high interest credit card

- Auto repairs (rebuild engine, need a new transmission, etc)

- Home repairs (water damage, roof repair, etc)

I also favor service men. Not one service man has ever stiffed me! Even some of the old "D" loans that I made.

Additionally the maximum amount for any loan is now $ 25. So I diversify!

My current stats.

I am currently investing $ 25 in new Prosper money every week.

I you are interested in becoming a prosper borrower or lender, feel free to contact me (via the contact form (link at the very bottom of my blog) and I will send you an invite.

ReplyDeleteI always forget to do this. I hopped on this morning and reinvested 25$ I had made, but also saw that of my two notes I invested in, 1 has defaulted, and the second is two months late. :(

ReplyDeleteOh well. I think I may try to do what you do and do 25$/week.

This comment has been removed by the author.

ReplyDelete