Wells Fargo "taken behind the woodshed" - time to Breakup Wells Fargo?

The Fed's unprecedented slap at Wells Fargo may cost the bank more than just $400 million this year

Excerpt:

Last week's unprecedented rebuke on Wells Fargo from the Federal Reserve was noteworthy in a number of ways. Never before has the Fed placed a firmwide limit on a bank, stopping them from growing.

Outgoing Fed Chair Janet Yellen described the growth restriction as "unique and more stringent then the penalties the Board has imposed against other bank holding companies for similar unsafe and unsound practices, but is appropriate given the pervasiveness and persistence of the problems at Wells Fargo."

The Fed has enacted this by preventing the bank from growing assets. This means, that all else equal, the bank cannot write any new loans. However, there are some changes within their balance sheet that they can make in order to be able to lend, such that they remain "open for business" in CEO Tim Sloan's words.

Still, these changes may cost them in the region of $400 million of earnings for this year alone, according to the bank's estimates. The rationale for this particular form of punishment stems from the bank having prioritized growth since the financial crisis. In the Fed's view, Wells Fargo failed to increase risk management and oversight alongside that growth. Thus, the central bank decided to limit growth until things like risk management catches up. It also felt the incentive for Wells Fargo to act will be strong, since they will be starved of the growth they seek in the meantime.Maxine Waters: I want to break up Wells Fargo (9/2016)

Excerpt:

The top Democrat on the House Financial Services Committee said Thursday that she is actively working to break up Wells Fargo. Rep. Maxine Waters (D-Calif.) announced that the creation of potentially 2 million fake accounts by bank employees has led her to believe the bank is too large to be effectively managed.

“I have come to the conclusion that Wells Fargo should be broken up. It’s too big to manage,” she said. “I’m moving forward to break up Wells Fargo bank.” Waters made her announcement at a hearing with John Stumpf, the bank’s CEO and board chairman. For several hours, Stumpf was excoriated by members of both parties by the wrongdoing at his bank. The bank potentially created more than 2 million accounts without authorization from customers in order to meet sales goals.Warren Statement on Fed Chair Yellen's Regulatory Actions Against Wells Fargo

Excerpt:

Today, United States Senator Elizabeth Warren (D-Mass.) released the following statement on the Federal Reserve's decision to freeze the growth of Wells Fargo and remove four of its board members:

"For months, I have repeatedly pressed Janet Yellen to hold Wells Fargo accountable for its fake accounts scam and push out responsible Board Members. Today she did it - in her last act as Fed Chair. Fines alone will never rein in fraudulent behavior at the big banks and by pushing out Board Members at Wells Fargo, Chair Yellen sends a strong message. Her decision today demonstrates that we have the tools to rein in Wall Street - if our regulators have the guts to use them," said Senator Warren. "The massive fraud at Wells Fargo showed the whole country that we need more accountability on Wall Street. But for more than a year, we've watched as President Trump and his administration raced to turn big banks loose again to once again threaten our whole economy. Trump has filled our top economic jobs with people obsessed with sucking up to Wall Street. Today is Chair Yellen's last day at the Fed. Tomorrow, her replacement will face a choice: show the same kind of courage - or own the next financial crisis." Today, Chair Yellen sent a letter in response to Senator Warren's many calls for removing Wells Fargo Board Members. Read the letter detailing the Fed's actions against Wells Fargo here.

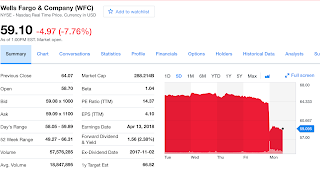

Comment: Reader may think that I care (or am biased) because I am a Wells Fargo retiree. I actually am neutral. As a customer I am very happy with Wells Fargo but I could just as easily be with Charles Schwab. While we are very diversified, we are also Wells Fargo investors. The stock did take a hit today!

Final: Look ahead to the mid-terms. Imagine a Democratic sweep! Maxine Waters as the chair of the House Financial Services Committee and Elizabeth Warren as the chair of the United States Senate Banking Subcommittee on Financial Institutions and Consumer Protection Update:

Statement from $WFC #WellsFargo #TimSloan

— James Peet (@jrpeet) February 5, 2018

https://t.co/pullb5f5rv pic.twitter.com/vyNTtto0Lo

Jim, since the bank has a history of laundering drug money, I wonder if anyone can in good conscience continue to own their stock, work there, or have a bank account there?

ReplyDeleteI'm going to call that "water over the dam"

DeleteLessee....feds give a huge incentive for banks to merge, then complain that they are too big to manage. Maybe.....time to rein in not WF, but the federal government?

ReplyDeleteI do agree with the sentiment that Trump has put too many people from Goldman Sachs into positions. I like Trump and am a firm supporter, but I do very much disagree with putting Goldman Sachs people into power. What I don't get is many of those same people who are "never-Trumpers" think that Lyin' Ted was a better candidate. What?! How can anyone be that naive? Unless I'm missing something, I didn't see anything in his campaign that distanced himself from GS further than Trump did.

ReplyDeleteThis:

DeleteGoldman Sachs will continue encouraging employees to take positions in government, according to the bank’s annual letter to shareholders Thursday.

While space in the letter has usually been reserved for financial results and corporate responsibility initiatives, this year, CEO Lloyd Blankfein dedicated a half a page to defending the bank’s ties to the White House and Capitol Hill.

“The charge is that Goldman Sachs is able to extract certain advantages that others cannot. In fact, the opposite is true. Those in government bend over backward to avoid any perception of favoritism,” Blankfein wrote in the letter, which was paired with a group photo of Blankfein and his two new COOs—a position where Gary Cohn sat in years past. “That is why we will continue to encourage our people to contribute to government service if they are fortunate enough to be asked.”

Wouldn't you want some smart financial guys if you're working a four trillion dollar budget? There are now precisely three GS alumni in the administration. Is that that huge?

DeleteJim, thank you for the excerpt. That article is written by GS people and they actually admit that they will gladly put their people into government positions! Wow, that is truly scary! I still don't get how some people thought that Cruz was a better candidate that Trump. Cruz did not make enough of an effort to distance himself from GS and I for the life of me cannot see how so many people missed that point and actually thought he was a better candidate than Trump.

ReplyDeleteBike Bubba, are you trollin' us? GS is the epitome of world socialism and globalism. If you're into that kind of thing, then great. But if you like freedom and independence, then having this organization represented is not ideal.

ReplyDeleteOr perhaps it's because I've heard the argument about Goldman Sachs being that, but have seen absolutely no evidence. "In God We Trust; all others must provide data", as Deming liked to say.

DeleteBike Bubba, now I really do think you're trolling us, or "yanking' our chain," as the kids say. Can you really with a straight face that you see no evidence of GS being part of a world cabal to bring us into globalism, which is really just worldwide socialism, which is the end of freedom??? I have a hard time believing that you "see no evidence."

ReplyDeleteThe financial elite who control the world are not "freedom-loving, free market capitalists." I don't buy it. I think you're playin' us.

Speaking of financial and political things, what did you think of the Dow dropping 666 points right after Trump's speech? The markets are manipulated and this was a message. These people speak in code and this was a direct message.