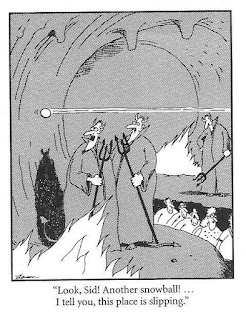

John Stumpf's survival chances

Warren Buffett to Fox Business: I'll Remain Silent on Wells Fargo for Now

Excerpt:

If history is any guide, Buffett can't be thrilled about the ethics lapse.

25 years ago this month, Buffett testified before a Congressional sub-committee regarding the Salomon Brothers bond scandal. Buffett had become a major shareholder in Salomon when it was revealed that traders had been submitting false Treasury bond bids in order to skirt trading rules. Buffett swiftly took over as CEO and fired a number of management.

At the time, he said during the testimony, "Lose money for my firm and I will be understanding; lose a shred of reputation for the firm, and I will be ruthless."Whipping Wells Fargo - The bank blundered, and the politicians will make it pay.

Excerpt:

Now we see that even bread-and-butter retail can lead to political retaliation as Senators call for Mr. Stumpf to resign and demand a criminal investigation. Readers know that unauthorized accounts are an affront to customers, but Senate progressives on Tuesday described sales targets as inherently evil. Senators also want executive-pay clawbacks, though the scandal has hardly dented bank earnings.

Mr. Stumpf, who will be lucky to survive as CEO, is learning the hard way that as long as banks remain public utilities they are a lousy business.Comment: "Buffett's Berkshire Hathaway (BRK.B) holds a near 10% stake in Wells Fargo (WFC). The Oracle of Omaha has been a longtime fan of the company but his silence may speak more loudly after Wells Fargo CEO John Stumpf gave a rocky performance on Capitol Hill before the Senate Banking Committee Tuesday morning. " My view below:

Wells Fargo once a "most admired" company! Since breaking of the scandal, Wells Fargo has lost $ 25 Billion in Market Capitalism. "“The stock has gone from loved to loathed in two to three weeks"

Wells Fargo is absolutely getting hammered on social media. Snip from Facebook below:

Updated: Multiple fired Wells Fargo employees report to CNN that they were fired after calling ethics hotline.

I can only get the previews, but the phrase "bankers work for the government" jumped out at me. Just plain scary, really.

ReplyDeleteTwo more things. First of all, Fauxcohontas (Sen.Warren) is reproaching WF for dishonesty? Seriously?

ReplyDeleteSecond, I remember a time or two having things to share about employers, and yeah, I just went to the SEC and did not go to the ethics hotline for exactly this reason. I also remember a time a manager got bad feedback and more or less asked who it was to speak up. I didn't bite on that one, either--I was the bad review, and he'd earned it by slandering me on my annual.

More calls for Stumpf's firing:

ReplyDeleteWells Fargo bank scandal is different in this one huge way:

Wells Fargo broke the cardinal rule: It went directly after the mom-and-pop bank branch customer. Not that it is right to cheat anyone, but hey, the rest of Wall Street does have its standards.

We're not talking about some esoteric product like a credit default swap that was conjured up in a Wall Street tower, spreading toxic risk over thousands of supposedly sophisticated institutional investors.

Nor are we talking about giant financial institutions fighting over investment banking deals. We're talking about you, me, our spouse, parents, friends and kids directly being cheated by people we know inside our community, whose weapon of choice is common, everyday checking accounts and credit cards. How dare they!

I think most people still don't have a clear understanding of what went wrong when the housing bubble led to the Great Recession. But this time the scandal is easy to grasp, even if the scale of it — millions of accounts opened in the name of unwitting consumers — is breathtaking.

That's what's different about this scandal. And that's why the CEO and the entire board of Wells Fargo have to leave right now. We're talking about the people customers see every time they walk into a branch. It is sacrosanct that you don't go after the little guy who may be less financially sophisticated and often unaware that he is getting ripped off.

Here's the thing you may not have thought about. My fellow financial services colleagues and I are also outraged over this. This isn't a matter of gaining new clients from a competitor gone awry, it is a devastating blow to the last bastion of safety in financial services — that you're perfectly safe inside your neighborhood bank branch.

The people who perpetrated this scandal didn't even need to wear masks to rob investor/clients. All they had to do was take advantage of those people's hard-earned trust. We all can relate to how terrible that is, which is why even Republicans and Democrats in the Senate were totally aligned in their grilling of Wells Fargo's CEO, John Stumpf.

....

The CEO needs to go so the bank can become a leading example of what serving the public is all about. And Wells Fargo will have to do things for customers to get them to come back. But they will, eventually. And I'll bet you that in two years no one will be talking about this and Wells Fargo will have lost very little business — if Stumpf is shown the door.

Pressure Mounts on Wells Fargo CEO John Stumpf - Embattled chief executive steps down from Fed advisory council after Democratic senators urge his rejection, while also calling for probe into bank’s labor practices

ReplyDeleteThe San Francisco Fed said later Thursday that Mr. Stumpf had stepped down as a representative to the Federal Advisory Council, a group of 12 bankers that meets four times a year to discuss economic and banking matters with the Fed’s board of governors in Washington.

“John made a personal decision to resign,” a Wells Fargo spokesman said. “His top priority is leading Wells Fargo.”

Comment: 1st comment in the WSJ comment section is "Dead meat."

Finally, something that unites Congress: Outrageous corporate behavior:

ReplyDeleteOn Tuesday, Sen. Jon Tester (D-Mont.) leaned onto his elbows, peered over his glasses and told John Stumpf he had done the nearly impossible.

"You have done something that has never happened in the last ten years and united this committee on a major topic," he told Wells Fargo's CEO, who'd been hauled to Washington for a hearing after his bank had fired 5,300 employees for creating phony bank and credit card accounts for customers. "And not in a good way."

Editorial in support of Stumpf:

ReplyDeleteStop beating up on Wells Fargo and John Stumpf:

... how big a scandal is this and how large was its impact on Wells Fargo's stock price (and hence executive bonuses)? Consider the fact that the fake accounts generated $2.6 million in fees over a four-year period. That is a drop in the bucket (0.011 percent to be precise) compared to Wells Fargo's annual net income of $23 billion. If this is the full extent of the fraud (something that we don't know, yet!) then this is certainly not the most egregious example of corporate misconduct to boost accounting profits/bonuses we have seen in recent years.

These fake accounts certainly did not cause Wells Fargo valuation to double over 2011-2015, and they should certainly not cause the recent steep decline in its stock price. It would seem that the $25 billion drop in its valuation and a slash of its ratings (by analysts at its competitor J. P. Morgan) is an over-reaction.

...

When Wells Fargo implemented financial incentives to reward employees for meeting aggressive cross-sales targets, they were following, what are considered "best practices" across entire firms across entire industries. Is it really right to fault the CEO for following best practices? Surely, the scandal suggests we should revisit the entire issue of how to set goals for employees that rewards and encourages right behavior on their part, but hardly requires that we single out Wells Fargo.

It strikes me that the connection between Stumpf and the misbehavior is tenuous at best. Would be nice if we could get to a point of actually punishing the guilty parties, especially since politically driven persecutions tend to leave the corporate culture firmly in place.

ReplyDeleteSetting the stage for the next disaster, of course. Sigh.

Wells Fargo Board Actively Considering Executive Clawbacks

ReplyDelete- Board likely to claw back at least some pay from former retail banking head Carrie Tolstedt and CEO John Stumpf:

Wells Fargo & Co.’s board is actively considering whether to claw back pay from former retail-banking head Carrie Tolstedt as well as from Chief Executive John Stumpf, according to a person familiar with the matter.

The board is deliberating in the wake of the bank’s sales-tactics scandal and could make a decision as soon as Tuesday, the person said. The board wants to take action before Mr. Stumpf returns to Capitol Hill; he is scheduled to testify Thursday before the House Financial Services Committee.

Does anyone know if this place has laundered as much drug money as HSBC?

ReplyDeleteThe good thing for this company is that this will be completely forgotten and no one will care anymore once Deutsche Bank goes down. That will create such a financial disaster worlwide that this silly little story will be forgotten.

ReplyDelete