Bitcoin, Gold, Cash, or Equities

Let's start with a hypothetical $ 10,000 (that I don't have). But upcoming the hypothetical investor is about ready to receive $ 10,000: perhaps from a bonus, an inheritance, a tax refund or pennies from heaven. What would I do?

This expresses my view perfectly: Bitcoin and the Incredible Power of Fiction

"When the history is written, cryptocurrencies will likely be described as one of the most brilliant scams in history." ... "We all laugh at primitive tribes which used large stones (or pigs) as currency. Well, laugh as you will, but a stone or a healthy pig is something. Cryptocurrencies are nothing except the marketing power of inventors, financiers and others who love the idea of buying a black box (which is obviously empty) for the price of a Kia and dreaming that it will turn into a Mercedes. There have been times recently when this dream has materialized within hours. This is not just a bubble. It is not just a fraud. It is perhaps the outer limit, the ultimate expression, of the ability of humans to seize upon ether and hope to ride it to the stars."As an aside, I have .0039 in Bitcoin. I "invested" a dollar 3 years ago.

A metals broker I have used: Apmex

Negatives:

Positives:

- Must be stored (safety deposit box)

- No dividend

- While there is a market, there's no ready market: to sell you have to box, insure and ship

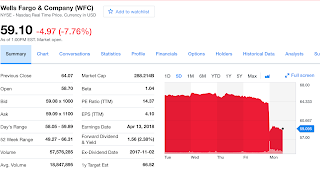

- Some view Gold the same as Bitcoin: "“(Gold) gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.” ... "Whereas, you know, Coca-Cola (KO) will be making money, and I think Wells Fargo (WFC) will be making a lot of money, and there will be a lot — and it’s a lot — it’s a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that." Warren Buffett

- If the sky ever falls ... (remember ... if the world "ends" the Internet will be down!)

- Beauty

- Makes a nice gift to grandkids when they turn 18 (my plan!)

- You can buy an ETF

- To counter Warren Buffett:

At today's rate, $ 10,000 will buy you this:

Have an solid emergency fund: How to Build an Emergency Fund When You're Counting Every Penny - There are ways to save money even when money is tight

You’ve heard it time and again: It’s important to set aside three to six months’ expenses for an emergency fund. Easier said than done, right? If you have a lot of debt, live on a fixed income or have unpredictable expenses, putting aside that much money can seem nearly impossible. The good news is you don’t have to do it all at once - even a little money in savings can go a long way.Comment: $ 1,000 isn't enough! If you have none, use that $ 10,000 for your emergency fund!

I'm going with Warren's view expressed above. I have an emergency fund. I've got my couple of coins. I would go with a solid dividend stock like sleepy General Mills (in the news today because they are acquiring Blue Buffalo). 100 shares of GIS (which pays a 3.6% dividend) for about $ 5,400 and 100 shares of Coca-Cola for about $ 4,400 (pays a 3.6% dividend as well)

Comment: If interested in Bitcoin, Coinbase is a good place to buy. But it's funny money

Ethereum founder warns cryptocurrencies 'could drop to near zero at any time' https://t.co/bcsKYb8bjw via @YahooFinance— James Peet (@jrpeet) February 25, 2018

BBC News - Bill Gates says crypto-currencies cause deaths https://t.co/pJYudnBLVt— James Peet (@jrpeet) March 1, 2018

Bitcoin faces regulatory crackdown, Bank of England warns https://t.co/nyYC0t8Epw— James Peet (@jrpeet) March 2, 2018

21 questions but zero Bitcoin—50 Cent has admitted he's not a Bitcoin millionaire https://t.co/aogDB6oPEV pic.twitter.com/LEGnxvv4bY— Bloomberg (@business) March 3, 2018

Crypto investing comes with a big risk: the exchanges https://t.co/5lQgWbtHQw via @WSJ— James Peet (@jrpeet) March 3, 2018

Contrarian view: Bitcoin is a better goldBitcoin is for fools, says BoE governor Mark Carney https://t.co/EninTXqGo6 via @ThisIsMoney— James Peet (@jrpeet) March 3, 2018

Bitcoin will someday be worth as much as 40 times its current value, says Cameron Winklevoss https://t.co/p2EuXbyX3P— James Peet (@jrpeet) March 4, 2018

Putting bitcoin in your IRA can sink your retirement https://t.co/E5CWYVvJ2X— CNBC (@CNBC) March 6, 2018

Bitcoin is the greatest scam in history https://t.co/hPAHUTMcfp via @Recode— James Peet (@jrpeet) April 26, 2018

#WarrenBuffett on #bitcoin : "it lacks intrinsic value"https://t.co/gH4ongAeXH pic.twitter.com/KmpQ9Mr2ss— James Peet (@jrpeet) May 3, 2018

Mr. Buffett's views on cryptocurrencies like bitcoin.— James Peet (@jrpeet) May 5, 2018

The Berkshire chief minced no words: "Cryptocurrencies will come to bad endings."https://t.co/SbgaX6QUPm pic.twitter.com/1DrU9GPIzz

On ICO'sCharlie Munger calls Elon Musk 'brilliant' and bitcoin 'stupid and immoral' https://t.co/tKI2rhEUWZ via @YahooFinance— James Peet (@jrpeet) May 7, 2018

The Sucker at the Token Table: Who Loses in the ICO Bust https://t.co/MhPrnE29uP via @YahooFinance— James Peet (@jrpeet) May 14, 2018

How much fraud is there in cryptocurrency markets? A WSJ investigation tallies the red flags. https://t.co/jJ77VapkRt via @WSJ— James Peet (@jrpeet) May 17, 2018

I don't either!The Kings are the world’s first team to mine cryptocurrency. Here’s why they’re doing it https://t.co/syOthxL5Ic— James Peet (@jrpeet) July 3, 2018

Home Depot co-founder on cryptocurrency: 'I don’t know what the hell it is' https://t.co/iZYanfTtVh by @aarthiswami pic.twitter.com/gtrrXUGL5e— Yahoo Finance (@YahooFinance) July 25, 2018

It could be "game over" for bitcoin, a top technical analyst says. https://t.co/kwQBDibC9X pic.twitter.com/jjQujDdCQm— CNBC (@CNBC) August 13, 2018

After the #Bitcoin Boom: Hard Lessons for #Cryptocurrency Investors https://t.co/5W8lQIaXov— James Peet (@jrpeet) August 20, 2018

-Jp: the phrase "Cryptocurrency Investment" is an #oxymoron

Write A Bitcoin Obituary Now, Before It's Too Late via @forbes https://t.co/UNMudqGXXw— James Peet (@jrpeet) November 7, 2018

been thinking of this cover pic.twitter.com/86LKfkooIO— Jim Aley (@jimaley) November 20, 2018

There's one financial rule that never goes out of fashion: If it's too good to be true, it surely is, @Noahpinion writes https://t.co/9D3stYU6pC via @bopinion— James Peet (@jrpeet) December 12, 2018

The introduction of Libra illustrated the real benefits of Bitcoin that was absent from Libra says @JoeSquawk

— Squawk Box (@SquawkCNBC) June 24, 2019

"It's clearly a positive for Bitcoin," says Susquehanna's Bart Smith. pic.twitter.com/GgRYh0y10n

Heard on the Street: Facebook’s cryptocurrency looks a lot like a money-market fund, a vehicle that has come under intensifying scrutiny from regulators https://t.co/hEPaQh0f7V via @WSJ

— 𝓙𝓲𝓶 𝓟𝓮𝓮𝓽 (@jrpeet) July 4, 2019

Bitcoin Rap Battle Debate: Hamilton vs. Satoshi (BITCOIN GIVEAWAY) [feat... https://t.co/DicxgjYkGA via @YouTube

— 𝓙𝓲𝓶 𝓟𝓮𝓮𝓽 (@jrpeet) September 5, 2019