Legal Headwinds for Minneapolis Lightrail

Freight railroad files lawsuit over Southwest light-rail route

Excerpt:

Planners of the Southwest light-rail project are facing another legal challenge, this time from a freight rail company that is slated to share a portion of the nearly 15-mile route between Minneapolis and Eden Prairie.

Glencoe-based Twin Cities & Western Railroad (TC&W) filed suit Tuesday in U.S. District Court in Minneapolis, claiming agreements crafted by the Metropolitan Council outlining how freight and light-rail trains will operate alongside one another are in breach of previous contracts, federal interstate commerce laws and the U.S. Constitution.

The lawsuit names the Met Council, which is planning and building the $1.9 billion Southwest line, as well as the Hennepin County Regional Railroad Authority and Canadian Pacific Railway as defendants.

TC&W officials say the agreements “will substantially and unreasonably interfere” with their ability to serve their customers — farmers and manufacturers in western Minnesota and South Dakota that depend on rail to haul their goods to market.Railroad not interested in negotiating with Met Council for Bottineau light-rail

Excerpt:

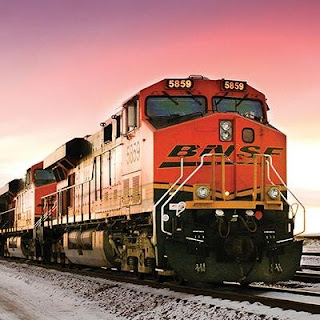

An executive with BNSF Railway has told the Metropolitan Council — again — that the company is not interested in sharing its rail corridor with the proposed $1.5 billion Bottineau Blue Line light-rail project.

In an April 24 letter, Richard E. Weicher, BNSF's vice president and senior general counsel, said the Texas-based rail company is "not prepared to proceed with any discussion of passenger rail in this corridor at this time." The letter was addressed to Daniel Soler, the Bottineau Blue Line's project director.

"As we explained in discussions some time ago, and again as recently as February, we do not believe the Blue Line light rail project would be consistent with our passenger principles or protect the long-term viability of freight service" in the corridor north of Minneapolis. (Weicher wrote a similar letter to the council earlier this year.)

The 13-mile Blue Line extension would link downtown Minneapolis with Brooklyn Park, operating along 8 miles of right of way owned by the Texas-based rail giant. The council, which is planning and building the project, must negotiate with BNSF to share the alignment north of Minneapolis.

Without an agreement in place with BNSF, the council cannot apply for $753 million in federal funding.Comment: Related U.S. House approves measure to undermine Met Council. Amendment linking transportation planning to elected membership would need to clear Senate before becoming law.

The Metropolitan Council would be stripped of its authority to distribute millions of federal transportation dollars if a provision approved by the U.S. House of Representatives on Thursday becomes law.

The measure, sponsored by U.S. Rep. Jason Lewis, R-Minn., tackles long-simmering complaints about gubernatorial appointees, rather than elected officials, leading the powerful regional government.

The council’s status as the Twin Cities’ official transportation planning organization is grandfathered into federal law, which otherwise mandates that those boards must have local elected officials.

“We now have in the Minneapolis-St. Paul region, the only board in the country that is entirely non-elected, the only [transportation planning organization] that has the authority to independently raise taxes and is non-elected,” Lewis said during debate on his amendment, tacked onto the Federal Aviation Administration reauthorization bill.

The measure’s future is uncertain in the Senate, which has yet to vote on its own FAA reauthorization bill. In a letter to the state’s congressional delegation Wednesday, Gov. Mark Dayton, a DFLer, warned that the change would “circumvent a long-standing and productive process at a time when transportation investment is critical to our region.”Opinion: I'm with Lewis on this - the Met Council is too powerful and not accountable to the electorate

The Bottineau Line light rail project can’t move forward without BNSF. And BNSF just told the Met Council to get lost https://t.co/bgXjk3w2Nj

— James Peet (@jrpeet) April 30, 2018